ETF vs. Mutual Fund: What’s the Difference? A Complete Guide

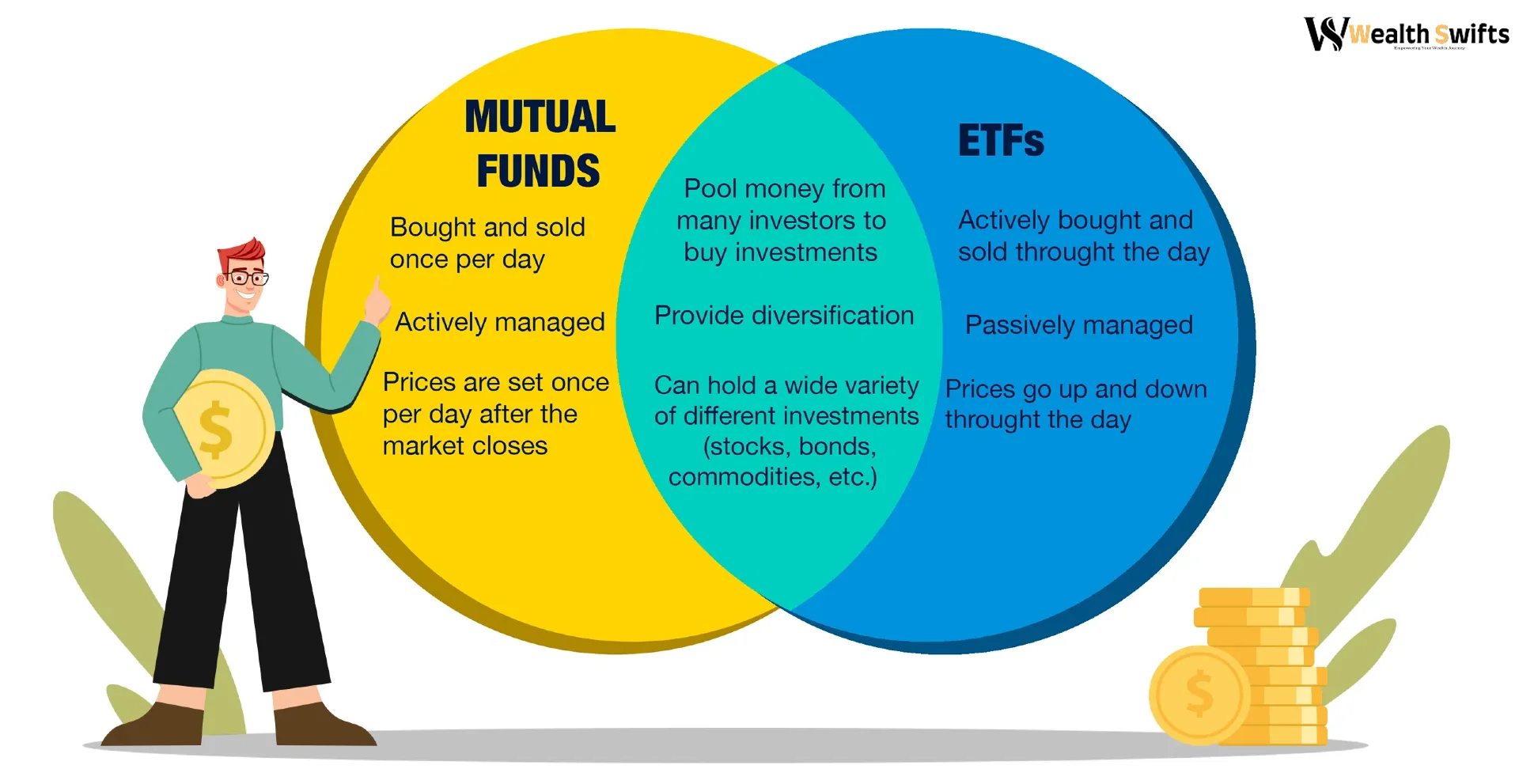

Mutual funds and exchange-traded funds (ETFs) share numerous similarities. Nevertheless, numerous critical distinctions could render one of the two more advantageous for your circumstances. We will examine the similarities and distinctions between the two instruments in this article, as well as how to determine which instrument is most suitable for your needs.

An exchange-traded fund (ETF)?

An exchange-traded fund (ETF) is an investment vehicle that combines funds from investors and utilizes the funds to acquire a portfolio of stocks, bonds, and other securities. The term “exchange-traded fund” is derived from the fact that investors can purchase and sell shares of an ETF in the same manner as they would purchase shares of a stock from a stock exchange, such as the Nasdaq or the New York Stock Exchange.

Commonly, exchange-traded funds (ETFs) correspond to a commodity or market index. Index funds are those that monitor an index. Nevertheless, the number of actively managed exchange-traded funds (ETFs) is increasing. An active fund manager endeavours to surpass a benchmark index by exercising greater caution in selecting stocks.

Investors are required to pay a fee to the fund company in the form of an expense ratio, which is a percentage of assets under management, in exchange for the convenience of an ETF.

The expense ratio can be extremely low for extensively traded broad market index funds, where the fund manager’s responsibilities are relatively straightforward. The expense ratio increases significantly for actively managed funds, as investors are required to pay for expert research and allocation management.

What is the definition of a mutual fund?

A mutual fund is a type of investment vehicle that combines the money of investors to purchase a variety of securities, including stocks and bonds. Investors acquire shares of a mutual fund directly from the corporation that issued the shares, such as Vanguard or Fidelity.

In contrast to exchange-traded funds (ETFs), mutual funds are more frequently actively managed. However, it is possible to acquire mutual funds that replicate a market index. Once more, index funds will typically have lower expense ratios than actively managed mutual funds, and the expense ratios are frequently identical to those of their ETF counterparts.

You will be unable to transfer the assets to another financial institution without selling them, as you are required to purchase and maintain shares of a mutual fund with the fund company that issued the shares.

Differences between an ETF and a mutual fund

The Differences between an ETF and a mutual fund can have substantial consequences for investors.

The pricing of the funds’ shares is a significant distinction to take into account. The value of ETFs is determined by market forces, as they are purchased and sold on a stock exchange. The fund may be priced at a premium to its net asset value, which is the underlying value of the securities it holds if there is a substantial demand for it.

The converse is also true. If there is an abrupt demand for the sale of shares of that particular fund, it may be priced below its net asset value. Typically, this is not a concern for the majority of ETFs with significant liquidity.

In contrast, mutual funds are consistently valued at their net asset value after each trading day.

Tax efficiency is an additional critical factor. ETFs are typically more tax-efficient than mutual funds because they are traded on an exchange rather than redeemed with the mutual fund company. Consequently, there is a buyer for every seller.

That may not be the case with a mutual fund, as a significant number of sellers will result in the mutual fund company selling shares of the underlying securities. This will result in capital gains tax implications for all shareholders, irrespective of whether they sell.

Commission fees, minimum investments, and the capacity to purchase fractional shares are among the other distinctions that will differ depending on the funds and brokers you are contemplating. Certain mutual funds have extremely low minimums, and they will be further reduced if you commit to investing consistently.

Many online brokers have reduced their standard commission to $0 and enable investors to purchase fractional shares, ensuring that you are not leaving cash on the periphery.

It is effortless to reinvest dividends from mutual funds by simply selecting an option. However, the ability to reinvest dividends from an ETF is contingent upon whether your broker provides a dividend reinvestment plan for your preferred fund.

Which option is most suitable for you?

Identifying the distinctions between mutual funds and exchange-traded funds (ETFs) can assist you in determining which is most suitable for your needs.

Use exchange-traded funds (ETFs) if you prioritize tax efficacy. Having greater control over capital gains distributions may be a deciding factor when investing in a taxable brokerage account. Tax efficiency is irrelevant when investing in a tax-advantaged retirement account.

You are a diligent trader. You prefer to implement margin in your investment strategies or establish stop-limit orders and limit orders. Because ETFs are traded similarly to equities, these strategies are accessible; however, they do not apply to mutual funds.

You are interested in obtaining low-cost exposure to a particular market niche without researching individual companies. Numerous ETF options benchmark niche market indexes. Mutual funds may provide exposure; however, they are frequently less tax-efficient or require active management, which elevates their expenses.

You have the option to switch brokers in the future. ETFs are effortlessly transmitted between brokers; however, mutual fund positions must be terminated before switching brokers. Subsequently, you would be required to reinvest the proceeds in mutual funds provided by your new broker.

If a comparable ETF you are contemplating is thinly traded, consider mutual funds. Large bid/ask spreads may be the consequence of limited liquidity for an ETF, necessitating a premium paid more than the fund’s net asset value. Mutual funds are perpetually valued at their net asset value.

You recognize the potential to surpass the market by employing active management. Although actively managed exchange-traded funds (ETFs) are available, they are scarce. The majority of exchange-traded funds (ETFs) are index funds, which merely replicate the market return.

Active management is necessary to surpass an index. However, it is important to remember that these funds often have higher fees and tax implications, and even with active management, outperformance is not guaranteed.

You are investing in segments of the market that are less efficient. Funds that are actively administered have the greatest potential to outperform in these regions. While highly traded markets, such as large-cap U.S. equities, are highly efficient, sectors with lower trading volumes have a significantly greater potential to benefit from active management research and strategy.

1 thought on “ETF vs. Mutual Fund”