ETF vs. Index Fund: What Are the Differences?

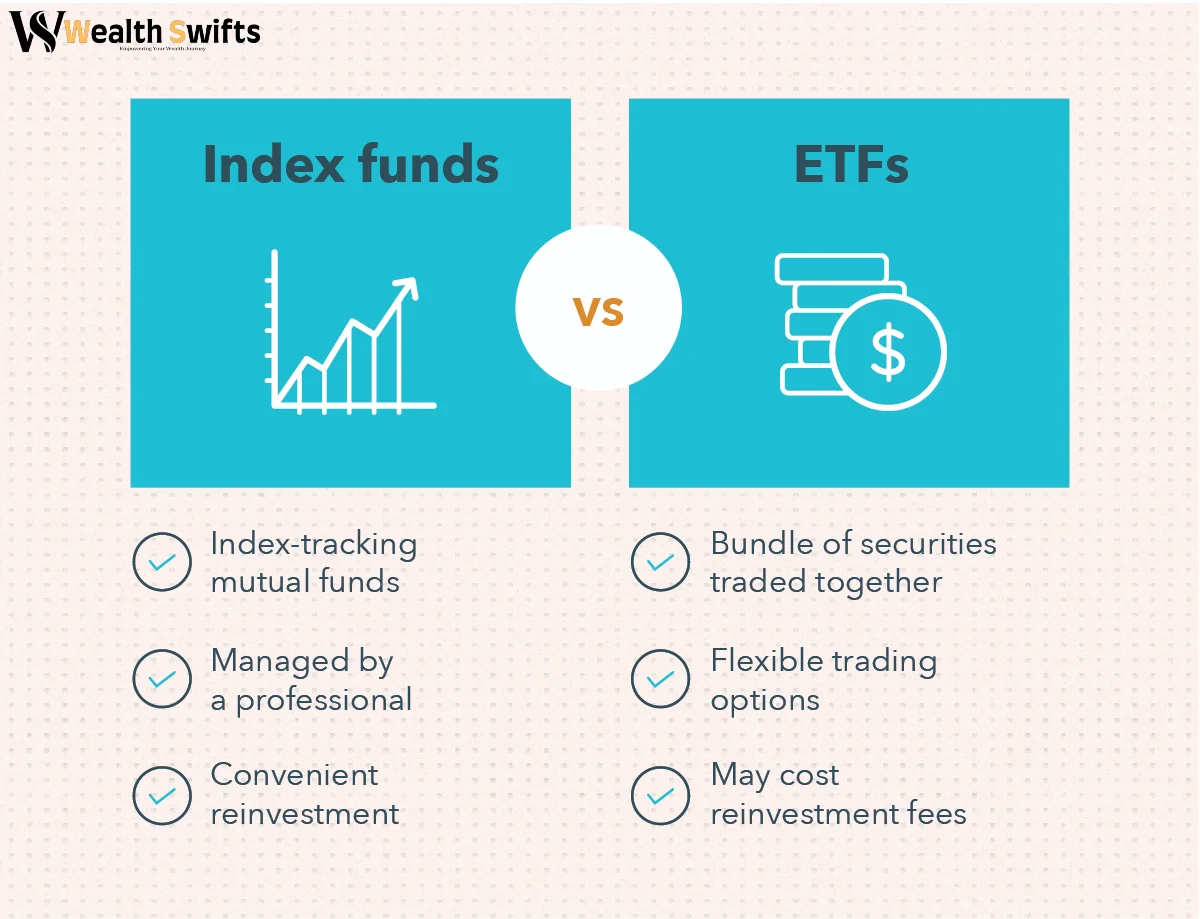

There are numerous similarities between index funds and exchange-traded funds (ETFs). Two passive investment vehicles combine investors’ funds into a basket of securities to replicate a market index. Actively managed mutual funds are designed to surpass a specific benchmark index. In contrast, ETFs and index mutual funds are typically designed to replicate and mirror the performance of a particular market index.

However, the disparities between an index fund and an exchange-traded fund (ETF) are not as trivial as they may appear. The focus is not solely on performance or the type of fund that generates better returns.

What is the distinction between an index fund and an exchange-traded fund (ETF)?

There are four primary areas in which the distinctions between an index fund and an ETF can be made: fees, minimums, taxes, and liquidity. These factors can assist you in determining which option is the most suitable for your needs.

-

Fees and expenses

The primary distinction between index funds and exchange-traded funds (ETFs) is their mechanisms for acquisition and disposition. Exchange-traded funds (ETFs) are traded on an exchange in the same manner as equities and purchased or sold through a broker. Direct purchases of index funds are made by the fund manager.

A commission will be paid to your broker for each trade you execute, as ETFs are traded on an exchange. That being said, some brokers provide commission-free trading.

The disparities between the purchasing and selling of index funds and exchange-traded funds (ETFs) are further complicated by dividend distributions. Dividends distributed by index mutual funds may be automatically reinvested into additional shares of the fund without incurring any fees.

Nevertheless, the earnings from a dividend paid by an exchange-traded fund (ETF) must be utilised to acquire additional shares, resulting in the imposition of additional commissions and the need to enter into your account to execute a swift transaction. Certain brokers may provide an automatic dividend reinvestment plan for a restricted number of exchange-traded funds (ETFs).

ETFs typically possess a minor advantage in terms of annual expense ratios, which are the percentage of assets that will be paid for fund management. However, in recent years, the disparity between expense ratios for index funds and extensively traded ETFs has diminished and nearly vanished. However, for more specialised indexes, expense ratios may vary significantly, with the ETF typically being the more advantageous option.

-

-

-

-

Minimum expenditures

-

-

-

Investing in an ETF with a minimum investment of one share was previously the most straightforward method for those with limited finances to begin investing.

The minimum investments for the most popular index funds have been reduced by numerous fund managers, allowing investors to begin investing with a relatively small quantity of money. In the subsequent summary, the minimum investments for S&P 500 mutual funds from three prominent asset managers are shown.

-

Taxation disparities

Investors who are investing for retirement over the long term should utilise tax-advantaged retirement accounts, including 401(k)s and IRAs. This is not only because it is shrewd, as we are all aware that minimising taxes results in more money in your purse, but also because it allows you to disregard the intricate details of the tax implications of investing in various types of funds.

Both index funds and exchange-traded funds (ETFs) are exceedingly tax-efficient, particularly when contrasted with actively managed mutual funds. Index funds rarely attract capital gains taxes for investors due to their infrequent stock purchases and sales.

ETFs are superior in terms of tax efficiency. Unlike index funds, exchange-traded funds (ETFs) seldom acquire or dispose of stock in exchange for cash. A shareholder may redeem their shares by selling them on the stock market, typically to another investor.

The index fund may be required to sell its equities for cash to compensate the investor for the shares when an index fund investor desires to redeem an investment. This implies that mutual funds must generate capital gains by disposing of equities, which induces capital gains (and taxes) for all investors who maintain their funds, regardless of their current investment losses.

-

Liquid.

The ease with which an investment can be purchased or sold for cash, or liquidity, is a critical differentiator between index funds and exchange-traded funds (ETFs). The same as previously stated, ETFs are purchased and sold like equities, which means that they can be purchased or sold at any time the stock market is open.

In contrast, index fund transactions, similar to those of all mutual funds, are processed in mass following the market’s closure. So, if you submit an order to sell shares of an index fund at noon, the transaction will occur hours later at a price that is equivalent to the fund’s value at market close.

Typically, the deadline is 4 p.m. ET. Those orders that are submitted after the deadline time are delayed until the following day and are finalised at the fund’s net asset value one day later.

If you identify as a trader, this is of significance. It is of virtually no consequence if you regard yourself as a long-term investor.

ETFs versus index funds

The most suitable investment option is an exchange-traded fund (ETF) for those who are active traders or prefer to employ more sophisticated strategies in their purchases.

You can purchase ETFs using limit orders, stop-loss orders, or margins, as they are traded on exchanges similar to equities. You are prohibited from employing those strategies with mutual funds.

An ETF may provide a little more tax efficacy than an index fund if you are investing in a taxable broking account. It is important to note that index funds are still highly tax-efficient, so the disparity is negligible. Avoid selling an index fund solely to acquire the equivalent ETF. That is a recipe for a plethora of tax-related complications.

Purchase an index fund if your broker imposes high commissions on your purchases and you desire to maintain a complete investment portfolio at all times. You may be able to begin investing in index funds with a lower minimum than the equivalent ETF in certain instances.

When the equivalent ETF is thinly traded, producing a significant spread between the ETF price on the exchange and the value of the underlying assets held by the ETF, index funds are also a viable alternative. The pricing of an index fund will always be determined by its net asset value.

Always compare fees to ensure that you are not paying an excessive premium for your selection. Expense ratios may serve as an effective deciding factor when contemplating between an index fund and an exchange-traded fund.

Do not waste this second opportunity to capitalise on a potentially lucrative opportunity.

Do you ever feel as though you made a mistake by not purchasing the most successful stocks? Then you will be interested in hearing this.

Occasionally, our team of analysts issues a “Double Down” stock recommendation for companies that they believe are on the brink of a breakthrough. For those who are concerned that they have already wasted their opportunity to invest, the most advantageous time to acquire is now, before it is too late. And the figures speak for themselves:

- Amazon: If you had invested $1,000 when we doubled down in 2010, you would have received $19,837.

- Apple: with a $1,000 investment during our 2008 double-down, you would have received $42,475.

- Netflix: Your investment of $1,000 during our 2004 double-down would have resulted in $371,550.